As we reach the big day of President-elect Barack Obama's inauguration, it would seem like an ideal time to talk about the greatest challenge facing his new administration- the triple whammy of economic meltdown, credit crisis, and crisis of consumer confidence. All of them have combined to create the “Perfect Storm�- what appears, to a small businessman like me, to be The Great Depression Part II. Obama believes that the way to get out of an economic toxic disaster caused by too much government spending and debt, is to spend more and go further into debt. Interesting logic.

Obama's solution for this economic tsunami is more government spending in the form of more bailouts; a massive trillion dollar (or close to it) economic stimulus package; and tax cuts offered to people that never paid taxes in the first place. What is so interesting about this Obama game plan, is that it proves that we have once again elected a President that is either ignorant or oblivious to the United States Constitution. Nothing in the Constitution authorizes any of this kind of federal government intervention. Virtually the entire Obama economic game plan is unconstitutional.

I, on the other hand, offer today an economic stimulus plan that is unlike any ever offered before. Instead of raising taxes on the successful Americans who pay most of the taxes and create virtually all of the jobs, I actually want to give taxpayers a one-year “Income Tax Vacation.� Yes, I want to suspend income taxes for 2009 and tell the I.R.S. to take the year off. I can hear the liberal, big-government, tax and spenders screaming right now. But before I explain the details of my plan, let's debunk a few great, big, fat liberal lies about taxes.

Liberal tax and spenders complain that we cannot possibly allow the Bush tax cuts to become permanent. Why? The federal government cannot afford it. The cost? About $400 billion per year. Until recently, that sounded like a lot of money. But not after the events of the last few months- now we all realize that $400 billion is chump change. How is it possible that we can afford to spend $80 billion on a bailout for one company AIG, but $400 billion in tax cuts for millions of hard-working American taxpayers is unaffordable? How is it possible we could spend almost $50 billion (and counting) on a bailout for the failed Big 3 automakers, but $400 billion in tax cuts for millions of taxpayers is unaffordable? How is it possible that our new President Obama could giveaway almost one trillion dollars in an economic stimulus package without hesitation, but $400 billion in tax cuts for the taxpayers is unaffordable? How is it possible that we could giveaway $7 trillion in total bailouts, but $400 billion in tax cuts is unaffordable and unimaginable?

Obama campaigned for President on the theme that extending Bush's tax cuts would be unaffordable and irresponsible. Yet now it turns out that when Obama wants to spend a cool trillion dollars on his pet project, it's available, reasonable, and necessary. Big fat liberal lie number one is debunked.

But the second line of reasoning by liberal tax and spenders is even more of a whopper. They say that a tax cut is a “giveaway to the rich� and that it's “unfair� and “greedy.� Really? How can it be a giveaway when it's our money in the first place? The very definition of a giveaway is when government is giving away my money to other people who didn't earn it. Now that's a giveaway. The real giveaway is Obama offering a “tax cut� to the 40% of Americans who paid no taxes last year. The real giveaway is the millions of people (virtually all Obama supporters) who are on welfare, Medicaid, food stamps, aid to dependent children, housing assistance, free school breakfasts and lunches, the list goes on and on. That's a giveaway. Big fat liberal lie number two is debunked.

Liberals like Obama call tax cuts “spending.� He claims that tax cuts add to the budget deficit. That's a blatant lie. Letting people keep more of their own money does not increase government spending. It isn't the government's money in the first place- it belongs to the taxpayers. So therefore it shouldn't be in the budget in the first place. How can you grab less of my money and claim that increased your budget deficit?

If someone stole your car, then had a change of heart and gave you the four tires back, would that be a “giveaway� to you? Would you feel like a welfare recipient because someone gave you back part of what they took from you in the first place? Would you thank them for being so generous and “fair?� Would you say they increased the spending in their personal budget by giving you back 4 of your own tires that they just stole? I think not. That's how millions of our most productive Americans feel when government says it adds to the budget deficit to allow us to keep more of our own money.

You mean when President Obama spends a trillion dollars on infrastructure building, that isn't called “government spending?� That doesn't add to the budget deficit? When Obama spends a trillion dollars giving money away to people that didn't pay taxes in the first place, that isn't called “government spending?� That doesn't add to the budget deficit? But letting taxpayers like you or me keep more of our own money- the one item that isn't spending at all- that is blamed for busting the budget? Wow, those liberal tax and spenders certainly have a way with words. Big fat liberal lie number three is debunked.

And as far as the “G word� greedy- well that's the biggest, fattest lie of all. You mean it's greedy to want to keep more of your own money, but it's not greedy to ask government to give you someone else's money? Big fat liberal lie number four is debunked.

Now into this picture of big fat lies enters Barack Obama with his first big act as President- an almost trillion dollar stimulus plan (which I predict after only a few months in office, he'll expand dramatically to far above one trillion dollars). He wants to build infrastructure with a large portion of it- highways, bridges, schools. By the way, many of these projects that he calls “necessary� are a bunch of fat, lard, pork and waste that until today used to be called EARMARKS. Now they will be packaged up in an economic stimulus package and called “necessary for the survival of America.� That's how politicians play with words to deceive the American public.

With the rest of the stimulus package Obama will send government checks to millions of Americans- many of whom never paid taxes in the first place; many millions of others have steady jobs and their income is no worse than last year (this category includes anyone that works for government). So why give them a check? The people who need the check are small business owners who are struggling because consumers have stopped buying. But none of the checks will go to them- they made too much money on last year's tax return. Obama has disqualified them.

Oh and just for good measure, Obama will spend a bunch of leftover money on creating 600,000 new government jobs that will bankrupt taxpayers not just today, but for many decades to come. Remember that those 600,000 new government employees require bloated salaries, pensions and health benefits for the next 50 years. This is Obama's version of Economics 101: Massive Spending + Debt added to More Massive Spending + Debt = Economic Recovery. Good luck to all of us. We'll need it.

But here's my version of an economic stimulus plan:

Let's give American taxpayers (ie those who actually do pay the taxes) a one-year tax VACATION. Yes, I want to suspend all federal income taxes for individuals for one year. Once again, Obama and his tax and spend friends will howl that we can't afford it. Really? The entire amount of income tax paid by individuals each year in the United States of America is about $1.3 trillion dollars. So as expensive as my idea sounds to suspend federal income taxes for a year, it's actually about the same cost as Obama's economic stimulus plan. It's also only a tiny fraction of the $7 trillion dollars the federal government has given away in bailout monies to rich, fat- cat corporations and bankers. It's far less than the $2 trillion or so in cash that the Federal Reserve has simply printed to put liquidity into the banking system.

But like all liberal tax and spenders, Obama doesn't want to simply let us all keep our own tax money for one year. Government wouldn't get enough credit for that. Obama wants government to meddle in our lives. Obama wants to be able to give our money away in the form of a government check- to make all of us dependent on government. He wants to take it from us (in the form of taxes), and then give it back (to some of us), so we're all awed by the power and generosity of government. He wants to choose winners and losers, by giving it back to whomever he decides is worthy. He wants to give the money away to people who did not pay taxes in the first place (his voters).

My plan chooses to give the trillion dollars or so away to the people that paid all the taxes in the first place. My plan simply allows the taxpayers to keep their own money- without ever getting government (or government checks) involved. For one year, you get to keep ALL of your own money. How's that for simple? My plan has no middleman (government) grabbing your tax money first and taking his cut. You just keep it all for a year. This is certainly no giveaway, considering that the money is going to the people that earned it- taxpayers.

But there are two problems for Obama and his liberal friends. First, most of the savings would go to the top 20% of earners, simply because that's who pays most of the taxes. How unfair. The people who actually pay the taxes would gain the benefit. And since they own virtually all the businesses in America, they'd pump the money back into their businesses, or create new ones- thereby creating millions of new jobs. That just makes too much sense for government.

Secondly, Obama's & Company would be petrified that my Income Tax Vacation would set a precedent. They'd be petrified that maybe if we all paid no income taxes for a year, we'd actually start to like it. Taxpayers might notice how much better their lives have become without income taxes. They might notice that all that extra tax money they keep improves their quality of life. And they might notice that nothing is missing from their lives- that we all get along just fine without those taxes. Obama & Company would be petrified that we'd all start to notice that the federal government could actually survive without collecting our income taxes. We might all demand that income taxes never be reinstated. Wow, how that thought must really frighten big-government liberals. They must wake up in the middle of the night sweating profusely. My version of the economic stimulus plan is the Liberal Nightmare.

Please keep in mind that my idea, unlike President-elect Obama's stimulus package, actually rewards and incentivizes the American citizens that fund virtually all the businesses in America; that create virtually all the jobs; that buy the luxury goods; that invest in the things that make our economy go and grow- stocks, bonds, real estate, investment property, small business. This is the group you want to motivate and stimulate. The American economy would start humming again. Americans would go back to work. Now that's an economic jolt. That's an economic stimulus. Put the money in the hands of those that create it in the first place. Put it in the hands of the same people that know what to do with it, in order to make more money.

Do you realize Obama's plan gives away money to everyone but this very group that I'm talking about above. Obama's plan takes the money from the taxpayers, and gives it back to everyone BUT the small business owners and job creators. Taxpayers like me rarely receive stimulus checks. I always earn too much. Isn't that amazing? I'm part of that heroic group that creates the jobs, and pays most of the taxes that pay for all these big government programs and overpaid government employees. But when it comes to stimulating the economy, I'm the last guy government wants to stimulate. Well, there are millions of Wayne Roots. We're the ones that government ought to be helping- or rather, not hurting. You should always help the people that stand the best chance of helping and uplifting millions of others.

But that is only Part One of my economic stimulus package. That's the first trillion dollars or so. We all know Obama's stimulus plan will be doubled or tripled or quadrupled. If not in 2009, certainly in 2010, you can count on Obama coming back for more, and more, and more. Because no matter how much he gives away, it will never be enough. So here are a few more ideas to motivate and stimulate the producers and earners and taxpayers and small business owners who make America go and grow. As opposed to Obama's wasted trillions, the ideas below will actually make money for the government. This is my Economic Stimulus Plan:

#1) The centerpiece of my plan is the One Year Federal Income Tax Vacation. We've already discussed this key idea in detail above. Now to the all-important corollaries.

#2) I propose a 5 year Capital Gains Tax phase out. Anyone who invests in America (stocks, bonds, homes, commercial real estate, small businesses, etc) deserves a reward for his/her risk- especially in today's frightening economic environment. I suggest phasing out capital gains taxes over a 5-year period. Any capital gains earned after one year = 15% tax rate, after two years = 10% tax rate, after three years = 7.5% tax rate, after 4 years = 5% rate, after 5 years = ZERO capital gains tax rate. My idea is simple: buy a piece of America and hold it for 5 years, and any profits earned are yours to keep- tax free. This is perhaps the most crucial moment in the history of America to encourage, motivate and stimulate risk (otherwise known as investment in America). My plan will unleash the greatest economic expansion and explosion in world history.

#3) I propose the elimination of all capital gains taxes on investments, dividends, and interest for Americans age 55 and older. The point of this idea is to reward older Americans who are entering their retirement years and allow them (after a lifetime of hard work) to retire on half the amount of savings (because they owe no taxes on their assets- the very things they'll live on for the rest of their lives). But it's the aftershocks of this idea that will help the American economy recover. With this kind of a reward, think of the trillions of dollars that older Americans will spend on investing in America- knowing that the big payoff will come from what they are leaving their children and grandchildren.

#4) I propose a business income tax cut. Corporate income tax rates in America are the 2nd highest in the industrialized world. Obama wonders why businesses are moving jobs offshore? We must cut corporate income taxes to 20% (or lower) to remain competitive and encourage big business to not move offshore, or ship jobs outside the USA.

But more importantly, to encourage the formation and success of small businesses- the economic engine of America- we must lower the income tax rate for small business to 10%. This tax reduction, combined with the 5 year capital gains tax phase-out discussed above, will encourage an incredible tsunami of investment into small business. That creates millions of new jobs and turns the deepest recession of our lifetimes into an economic renaissance.

#5) I propose cutting capital gains taxes on the profits from the sale of any American's principle residence to ZERO. To liberal tax and spenders who scoff at this idea, it was your hero Bill Clinton, back in the 1990's, who cut the cap gains tax on the sale of principle residences to zero on the first $500,000 of profit. But (as usual) this tax cut wasn't indexed to inflation. Today, with indexing for inflation, it would be far higher. If the idea was good enough for Clinton, it's good enough for me. But I'm adding a creative twist- I'm proposing infinity as the limit for your real estate investing success, profit and prosperity. Any American that invests (and risks) his or her hard-earned money in a principle residence and holds for a minimum of 2 years, gets to keep any and all profits. Buying your home is the single biggest risk of most American's lives. Why should government get a big chunk of our profits? What was their risk?

Pass this law and watch the housing market explode. Watch people who wouldn't even think of risking their money to buy a home yesterday, rush with both fists and both feet to buy a home tomorrow. The Home Industry is perhaps the most important business in America. As goes housing, so goes the American economy. If people feel their home is appreciating they feel rich, and they spend (on anything and everything). If they don't, they don't. This idea is how you get the economy moving again.

#6) To encourage the creation of millions of new jobs and the hiring of millions of Americans currently out of work, I propose a $7500 tax credit that goes directly to any employer who hires a new full-time employee during the next 3 years, increasing to $10,000 if the person they hire was out of work at the time. Government spending and hiring will not get us out of this recession (or depression). Only private industry and entrepreneurs will get us out of trouble. This is how you motivate private industry and small business to create jobs.

#7) If and when income taxes are reinstated (and unfortunately you know they will be), I propose a national flat tax with only two rates: 15% and 10%. But here's the creative catch. I call it a REVERSE FLAT TAX to encourage and motivate productivity and success. I propose a flat tax rate of 15% on any and all income up to $500,000 per year; then a 10% flat tax on any and all income above $500,000. That's it.

Does anyone in government ever think of why American business is successful? The biggest businesses in this country are successful because, the more their employees' make, the more they let them keep. Whether the industry is stocks, investment banking, real estate, insurance, mortgages, automobiles, retail sales, or even Hollywood talent agents- the best salespersons and producers (called “Rainmakers�) receive the highest compensation. Those who produce and earn the least, receive the lowest compensation. That's the way all successful businesses are run. You reward the 10% of employees at the top who always create 80% of the revenues (and success). They build your business from the top down. It's always been that way, always will.

But the American tax system is built backwards. We punish success. We punish the job creators. We punish the daring innovators and risk-takers. Don't we want to encourage someone to take their million dollars out of the bank, or out from under the mattress, to invest in stocks or start a business? Under the present income tax system, the more you make, the more the federal government takes from you, the less you keep. Now, that makes no sense whatsoever.

Why would we want to discourage success and achievement? The federal government should want to motivate America's best and brightest. It's certainly in their best interest to incentivize you and me to want to work 24/7; to want you and me to build more businesses; to want you and me to hire more employees; to want you and me to risk and invest more money; to want you and me to make more money. Greed, in fact, is good. Greed is what motivates us to serve others because when we make customers happy, they'll reward us greatly. Greed is good for America. Greed is good for the federal government. Greed is good for tax and spend liberals like Obama. The greedier I am; the more willing that I'll be to risk my capital; and as a result, the more tax money that will eventually flow to the government.

My Reverse Flat Tax finally solves that problem. Our tax system has operated backwards since inception. It does not motivate or reward success. To the contrary, it punishes success, creativity, ingenuity, and productivity. Once again, by restructuring the income tax system to emulate the most successful business models in America, we are treating government like a business; a business with common sense.

Because the proposed tax rate up to $500,000 is a flat 15%, my plan is “fair.� It treats virtually every America who earns anything from zero to $500,000 in the exact same way. All taxpayers, including lower income earners, get a low rate of taxation. No one can complain. Almost every American is in the same boat, except those who strive or risk to do even better. You can only win with my plan. There are no losers. There are winners, and even bigger winners. That's as fair as any tax system can get. Everyone does well, and there's an opportunity to do even better.

For those who argue that not enough tax revenues will flow to the government from my Reverse Flat Tax, that's the whole point. We have to first cut government spending dramatically and then we won't

need the same high level of taxation. Then we can afford to let the American people keep more of their own money in the first place. In my new book, “The Conscience of a Libertarian: Empowering the Citizen Revolution with God, Guns, Gambling & Tax Cuts� I will lay out in detail my plan for cutting government spending dramatically.

This is my Economic Stimulus Plan to get America going and growing again. Does it cost trillions of dollars? Sure it does. So do all of Obama's plans. So do all of Congress' plans. But my plan puts the money directly in the hands of the taxpayers, instead of diverting it through a middleman (called

government). My plan is based on business models that are proven successful over centuries. My plan is based on incentivizing all Americans to risk and invest and build. Mine is based on running the federal government (for the first time) like a business. Mine is based on allowing taxpayers to keep more of their own money, without depending on government to pick winners and losers. Mine chooses only one winner- the American taxpayer. Mine is THE GREATEST ECONOMIC STIMULUS PLAN EVER.

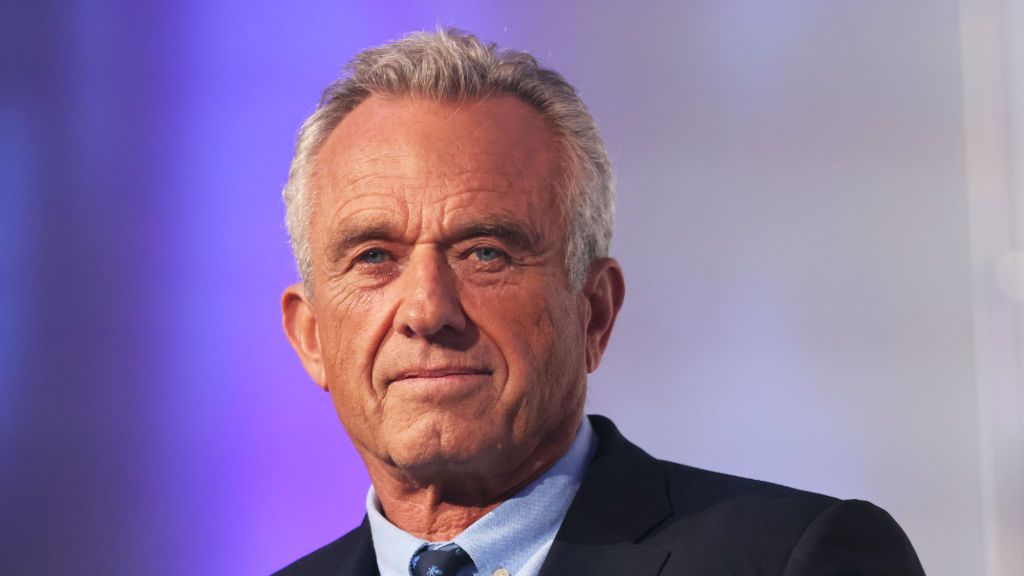

Wayne Allyn Root was the 2008 Libertarian Vice Presidential candidate. His new book is released by John Wiley & Sons in May entitled, “The Conscience of a Libertarian: Empowering the Citizen Revolution with God, Guns, Gambling & Tax Cuts.� For more of his views, commentaries and to watch his many media interviews, please visit his web site at: www.ROOTforAmerica.com