If you missed part 1, click Here to read it.

It is tax day, April 15, 2008. What a perfect day to announce our proposal to dramatically reform the American tax system. During this campaign for our party’s nomination, several of my esteemed opponents have spoken in favor of imposing a 30% national sales tax on all goods and services- combined with a check paid to everyone in the country (in the form of an automatic annual tax rebate – whether you’ve earned income or paid taxes, or not). Our campaign has received hundreds of requests to comment on the “Fair Tax,â€� many of them proponents. But after studying the proposal, we conclude that the “Fair Taxâ€� is a bad idea.

The so-called “Fair Tax� is not an advance for freedom; it is a prescription for tyranny and will relegate our descendents to being little more than welfare-dependent wards of the government.

Advocating a “Fair Taxâ€� is bad for our party and bad for America, and we believe that having our party’s nominee advocate this would tarnish the Libertarian Party’s brand.

Our campaign offers a competing vision.

Imagine instead a country where businesses and individuals would no longer need to account to the government for their income. Imagine a country where we can be free from the Internal Revenue Service. Imagine in one instant eliminating individual federal income taxes, corporate federal income taxes, payroll taxes, death taxes, the marriage penalty, excise taxes, and even the dreaded AMT (Alternative Minimum Tax) – all of it at once, gone forever.

No, this is not a dream. It can be a reality in a Root Administration.

Our campaign team’s economic brain trust has crafted an alternative approach that we believe will be attractive to America, consistent with our constitution and right in line with our libertarian ideals. Our plan completely rids America of federal income taxes and the I.R.S., while at the same time restoring power to the American people at the state and local level – just as our founding Fathers intended.

We propose eliminating the income tax and all other sources of federal tax revenues, including payroll taxes, excise taxes and import duties, and replacing it with only one tax: a tax on each state in proportion to its population, with each state deciding for itself how to raise its share of the money.

Not only would this eliminate taxes on income by the United States federal government, it would likely end taxation on income in virtually all states in this country. Most states calculate their own income taxes starting with the taxpayer’s calculation of Federal taxable income. It would be too costly for most states to enact their own income tax systems without being able to leverage the current system of W2s and 1099 filings.

To further reduce the likelihood of even some states imposing income taxes on their residents, if elected I will ask Congress to introduce legislation to update Public Law 86-272 to prohibit states from taxing the business activity of any person or enterprise engaging in interstate commerce, and define this broadly enough to include even the solicitation of customers in more than one state.

Our Founding Fathers understood the power of the purse as an instrument of tyranny. Today, because the U.S. Government taxes its citizens and then kicks back a portion of the money to the states (as it sees fit), the federal government exercises enormous unconstitutional power against the states through various federal mandates, ranging from No Child Left Behind to Real ID. Today’s regime of personal income taxation facilitates this mockery of our system of Federalism.

Our vision for dramatic change in U.S. tax policy is as simple as it is revolutionary in scope. With our plan there will be only 50 taxpayers in our country writing checks to the U.S. Treasury each year. With no other source of revenue to the U.S. Government, the balance of power would be forever dramatically reversed back to the states (just as our Founding Fathers envisioned).

Moreover, because these 50 states (and their taxpayers) will have a bias toward keeping tax dollars at home instead of sending them to Washington, they will have great incentive to mount enormous political pressure against Congress to reduce the size of government- thereby reducing both spending and taxes.

Some of the unnecessary and wasteful federal spending that would be first on the chopping block for this President (a perfect description for the son of a butcher) would be welfare, entitlements of all kinds including corporate welfare, dramatic cuts in foreign aid, a dramatic reduction in military bases across the globe, and dramatic cuts in wasteful pentagon spending. It’s high time to stop spending billions of our tax dollars to defend wealthy allies such as Japan, South Korea and Western Europe.

It’s time to de-fund and eliminate entire government departments and bureaucracies – starting with the Dept of Education (which is not authorized or mentioned in our constitution). The first step toward improving our education system (and saving our tax dollars) is to keep the money at the state and local level, giving less power to the federal government and teachers unions, and more power, freedom and choice to parents.

Under this plan, if Congress chose not to reign in out-of-control federal spending, it runs the risk that states could respond by withholding taxes from the federal government, which is the ultimate “check and balance.�

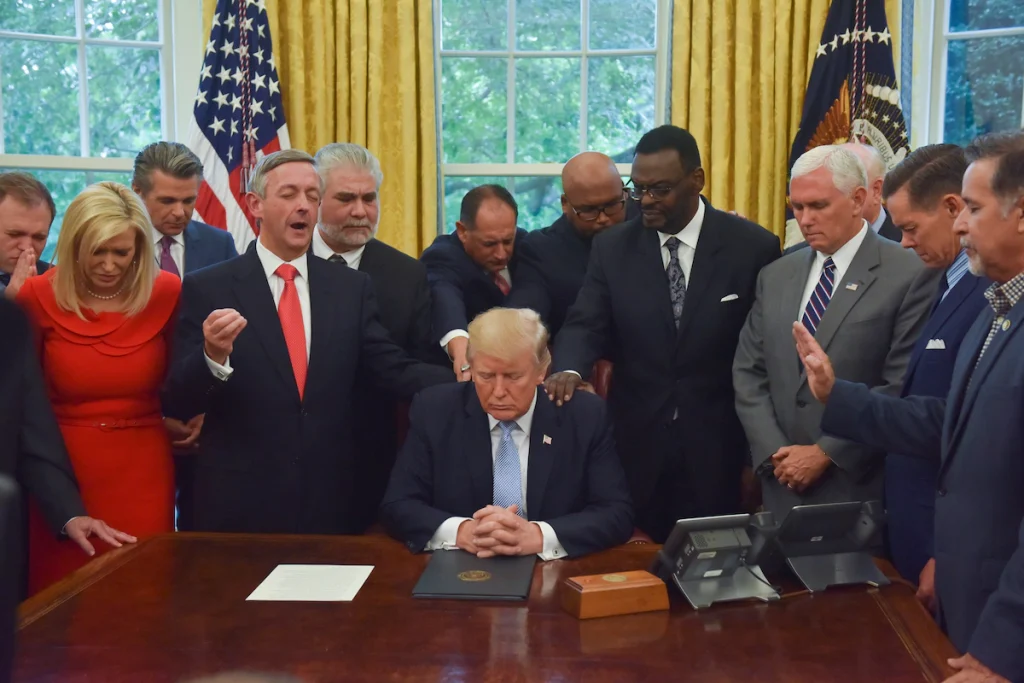

Power would be restored to the states, just as Thomas Jefferson envisioned when he authored the Declaration of Independence. Jefferson, arguably the most libertarian President in United States history, declared the primary responsibility of the American President was “to render ineffective and invisible the very government he is elected to lead.�

Jefferson and the Founding Fathers intended for taxes to be minimal and up to each state to decide. Jefferson said of taxes, “Government shall not take from the mouth of labor the bread it has earned.â€� Jefferson believed taxes were completely up to the discretion of individual states when he said, “The true theory of our constitution is that states are independent as to everything within themselves…â€� and even went so far as to recognize the right of states to nullify federal laws within their own borders, describing federal intrusion into state matters as “interference by a foreign government.â€�

Our founding father Thomas Jefferson would certainly approve of this plan to switch the power of taxation and spending decisions from the federal to the state level.

With this one sweeping change, devolving power from Washington to the states, tax and regulatory policy at the state level takes on greater importance. In this environment, competition amongst the states for business and residents would likely become fierce. States that impose high taxes or forms of taxation unpopular with their residents will be punished with losses in population. States that create an environment of low taxation and fair forms of taxation will be rewarded with population gains. Taxpayers will be better able to monitor how their money is spent up close and personal at the state and local level. A major shift of all taxation (and most spending) from the distant and draconian federal level to the state level can only be positive for the American taxpayer.

We believe this arrangement is exactly what our Founding Fathers intended – more power at the state and local level, less power at the federal level, and taxation determined by each individual state. This plan respects our Constitution, expands your personal freedom, restores power to the American people (and taxpayers), and increases the money you keep in your wallet. Please join us in this campaign to restore Federalism, returning power from Washington back to the states and to the people.

Root for Liberty! Root for Freedom! Root for America!